Our Commitment to you

Don't settle for someone who only talks about investments. Your life is bigger than a portfolio, and your financial plan should be too. When you work with me, you get a partner who looks at the whole picture and stays with you as it evolves.

Here’s what that means:

Investment guidance that fits your life

Access to well-researched solutions designed to grow your money with purpose, not noise.

Tax strategies that help you keep more

Smart, proactive planning so you’re not leaving money on the table.

A mortgage plan that supports your long-term goals

Debt can be a part of your overall strategy.

Estate planning that reflects your wishes

Clear advice so the people and causes you care about are protected.

Retirement income you can rely on

A sustainable plan that supports your lifestyle now and later.

Regular, proactive reviews

Your Living Plan isn’t a one-and-done document. We revisit it together to make sure it stays aligned with your goals, your needs, and the life you’re actually living.

Resources

Learn About Yourself

Retirement Readiness

5 min Quiz.

Brought to you by: Millie Gormely, CFP

Are you headed in the right direction? Take this short quiz to discover just how ready you are to retire. Uncover gaps in your planning, and any missed opportunities to make the most of your resources. Preparing for retirement can seem overwhelming, but tools like this can help you take control and ensure you’re moving towards the life you want.

IG Living Plan Snapshot

Find out how strong your financial plan is for: preparing for the unexpected.

Take the IG Living Plan Snapshot to get an understanding of how prepared you are and whether you are on track to meet your financial goals. After answering a few questions, you’ll receive a score for each dimension of your financial well-being.

Money Mindset

2 min Quiz.

Brought to you by: Millie Gormely, CFP

Most financial decisions we make are directly correlated with our personality and spending behaviour.

Get a better idea of your relationship with money by finding out your Money Mindset.

Did You KNow?

"Your giving should be as thoughtful as the rest of your financial plan." -Millie Gormely

MFA-P™

Master Financial Advisor - Philanthropy, Designation.

I completed my MFA-P™ Master Financial Advisor - Philanthropy, designation in 2025, and I’m genuinely proud of this one.

For years, I worked with people who wanted their money to do some good, but charitable giving often ended up as an afterthought — a quick “maybe make a donation for the tax receipt.”

Your generosity deserves more intention than that.

This program gave me deeper insight into how to build thoughtful, strategic philanthropy plans. You can align your values with your money in a way that creates real impact and still makes financial sense. Giving should be as intentional as the rest of your plan.

What this means for the people I work with:

We can now have richer conversations about what actually matters to you and build a giving strategy that supports the causes you care about — today and as part of your legacy.

Strategic philanthropy is becoming increasingly important, and truthfully, most advisors aren’t trained to navigate it well. Now I am.

If you’ve ever thought, “I want to give more, but I want to do it the right way,” we can figure that out together. Thoughtful giving is part of a thoughtful financial life.

"Money is not the enemy.

It’s not the definition of success.

It’s just a tool. But you need to learn how to use it with care and intention.

You’re the boss of it — don’t let it become the boss of you." -Millie Gormely

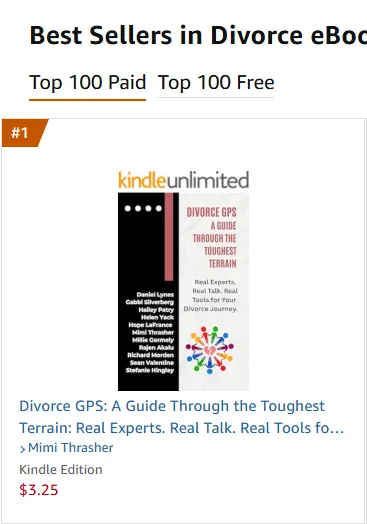

More Than Numbers: A Clarity-First Financial Workbook for the Life You Want

May 2026

Millie Gormely CFP® Author

The point of planning isn’t perfection. Nothing in real life is perfect. It’s about making the best decisions you can with the information you have at the time, and adapting as things change. In this workbook it provides you the framework to make those best decisions.

Frequently Asked

Who can I help

While I help my clients build long-term financial stability, my expertise shines brightest during life’s biggest transitions.

Whether you’re navigating a divorce, coping with the loss of a partner, or making important decisions about retirement, pensions, or long-term care—these are the moments when emotional overwhelm often meets financial uncertainty. And more often than not, I hear: “I just need someone to help me figure this out.”

That’s where I come in—with clarity, compassion, and a plan that makes sense.

I offer comprehensive financial planning, investment management, and insurance strategies for women living in Ontario with $250K or more in investable assets.

Services I offer

Retirement planning and Pension optimization.

Cash flow clarity and sustainable spending strategies.

Investment guidance aligned with your goals and risk tolerance.

Long-term care and insurance reviews.

Estate and legacy planning coordination.

Before becoming a CERTIFIED FINANCIAL PLANNER®

I worked as an insurance claims adjuster—helping people only after something had already gone wrong. That experience shaped how I work today: I meet women where they are, build relationships over time, and take a proactive approach to help them feel more in control of their financial lives.

My goal for you is simple

"To guide you through life’s changes—big and small—with advice that’s grounded, practical, and personal."

-Millie Gormely, CFP®

Learn How Millie's Guidance Can Support You

Ask Millie

Learn How Millie's Guidance Can Support You

Millie Gormely, CFP®

CERTIFIED FINANCIAL PLANNER®,

Master Financial Advisor - Philanthropy

IG Wealth Management Inc.

Mutual Fund Division

(807) 626-6527

Trademarks, including IG Wealth Management, are owned by IGM Financial Inc. and licensed to its subsidiary corporations.